How It Works

Join our investor communityPassive Investing Provides You

Cash flow

Equity

Appreciation

Tax Benefits

What We Do

We partner with experienced and seasoned syndication operators that we personally know. We invest in class B value-added multifamily apartments, in markets that are landlord-friendly, with a growing population and strong business fundamentals. We look for properties that are underperforming, that we can add value to by improving management, making capital improvements and effective marketing. Accepted properties are thoroughly underwritten using very conservative forward projections. We prefer investing in at least 100+ units. Our target is a 3-5-year hold with a 15% annual return.

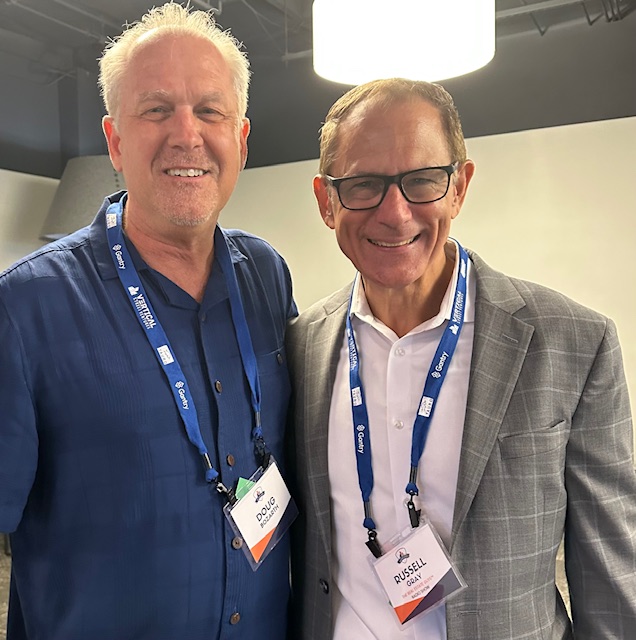

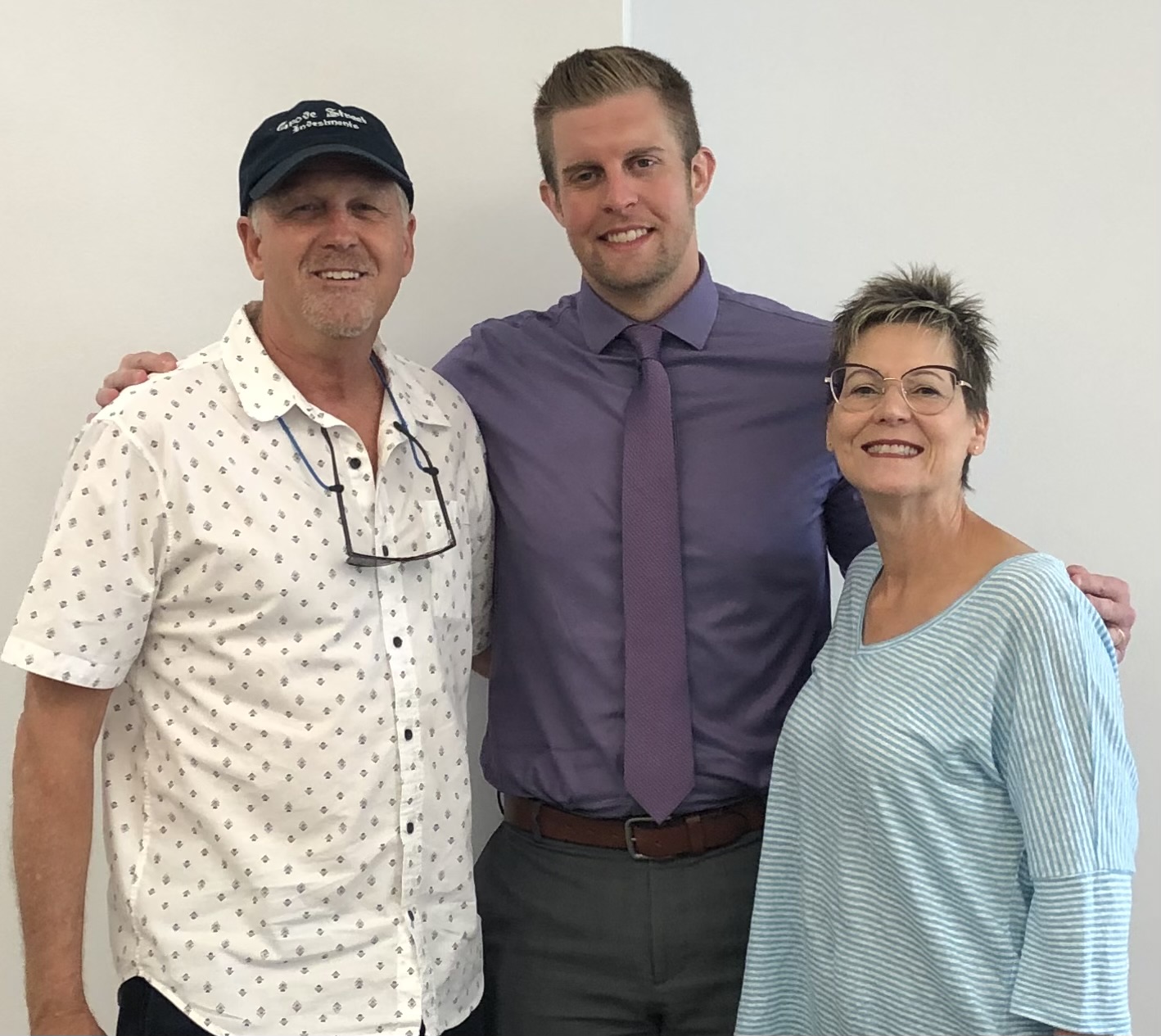

Who We Are

GroveStreet22 Equities is a family-owned company based in the thriving Dallas Fort Worth metroplex. Our Purpose is to build long-term appreciating cash flowing assets. Creating generational wealth while providing others an opportunity to achieve the same success we have experienced. We desire to be a bridge inviting other likeminded people to join our community of investors.

Why Passive Investing

Passive investing in real estate is by far one of the most effective strategies that a busy professional can utilize, allowing one to take their own financial future into their own hands. Passive investing allows to focus on being an investor, not a landlord, no need to worry about tenants, toilets or termites. Investing passively opens the door to above average returns, financial freedom and generational wealth. Why except breadcrumbs that wall street offers, i.e., stocks, bonds and mutual funds, when you can have the whole loaf of bread with butter.

Our Community

Scottsdale AZ. Vertical Street Venture event with Jerome Maldonado and friends.

Hunter Thompson, Scottsdale AZ.

Zach Haptonstall, CEO Rise48 Equity.

Dallas, TX Vertical Street networking event.

NYC Harlem, writers, actors Lisa Bostnar and Lorey Hayes.

Bronson Hill Podcaster and author, and Canadian entrepreneur friend Tracy Fihrer.

Phoenix AZ Working on our Underwriting skills.

Darin Batchelder and Palemon Camu